#NoCode CRM

Fully customizable CRM. As easy as Excel.

Try 14 Days for FREE

Pricing starts from $15. No credit card required.

Trusted By 2000+ Customers & CRM Experts

Awards

Finances Online

Software Suggest

![]() High Performer

High Performer![]() Business.com

Business.com![]() Red Herring Winner

Red Herring WinnerSoftware Suggest

Finances Online

Fully Customizable For

Your Industry

You can organize any data / process. Not just leads.

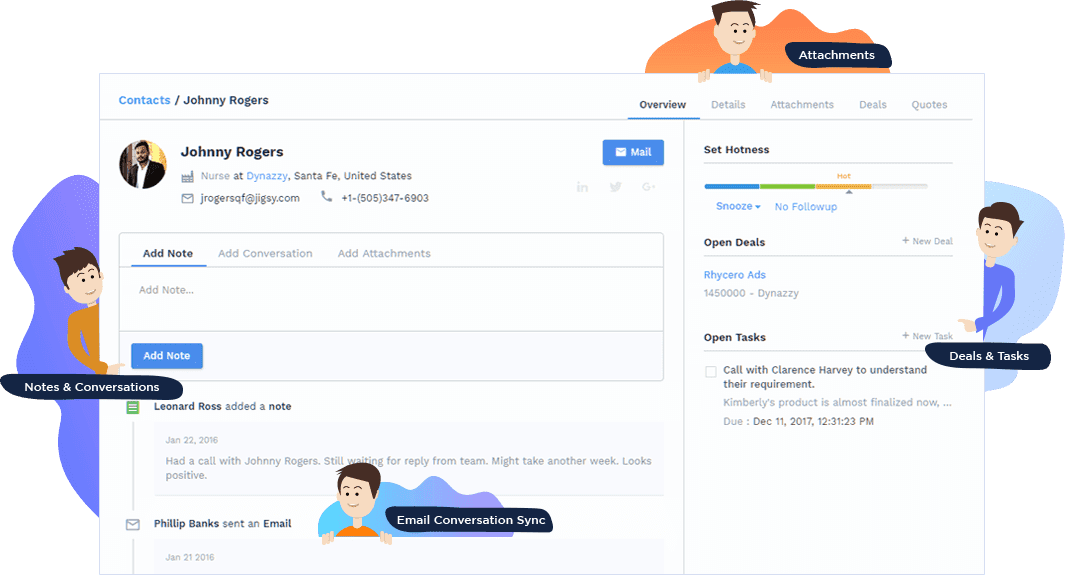

Get 360° View of Leads At One Place

See Conversations, Emails, Notes, Tasks, etc. at 1 place and decide next steps

Save At Least 2 Hours Every Day With

Complete Productivity Suite

Organize Your Data The Way You Want

With Drag-Drop Tools.

Custom Fields & Tables

Track all the information you need with custom fields & tables

Columns & Filters

See all the important information instantly by customizing columns.

Filter data in a click with saved filters.

Get "Easy As Excel" CRM Your Team Will Actually Use

Manage leads from a single page. Just like Excel.

Create Leads Instantly

Quickly create a new Lead /Contact without leaving the page

Edit Fields of Different Records Like Excel

Double click any field to make changes. And save all changes in 1 click.

Add Notes / Tasks / Conversations

Add activity also from same page

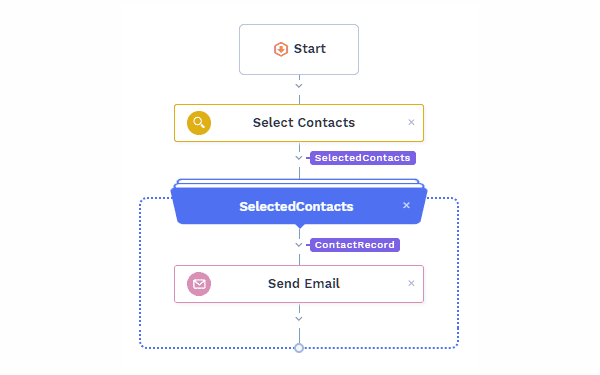

Automate alerts, reminders, lead assignment, detecting duplicates

or any other process in clicks with drag drop automation.

Every modern sales organization, like yours, must automate the

boring tasks and focus on productive things.

Automate almost anything in clicks

Create Professional Looking Documents In 1 Click

Custom branding and design, customizabe as per your needs

See sales activities, performance of sales team & customer

insights with very easy yet powerful reporting.

See sales activities

How many emails they sent, calls they made, new leads etc

Analyze Anything in Realtime

Sales, deal sizes, close rate, activities, comparative performance, etc.

Awesome Visualizations

- Area Chart

- Pie Chart

- Line Chart

- Donut Chart

- Pivot Table

- Scatter Chart

Dynamic Forms

Add rules to forms of Contacts, Companies, Deals etc.

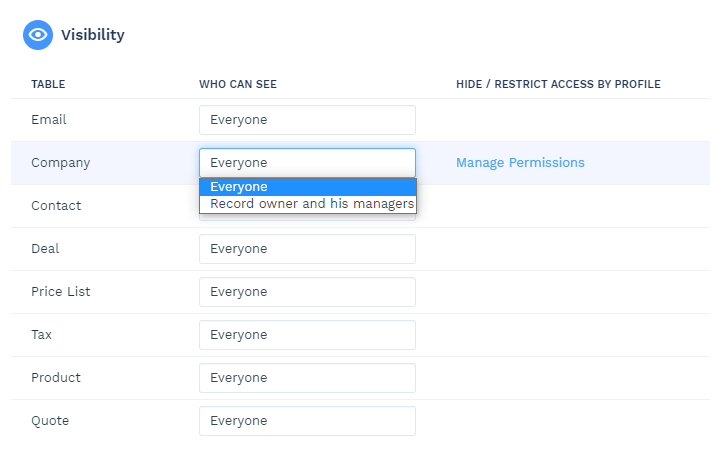

Data Visibility

Set visibility of data, control access to fields and operations

1 Click Integrations Using Integrately

Connect CompanyHub to 100s of other apps using our own integration platform, Integrately.

With CompanyHub you get seamless integration with all the popular applications

Integrately is the world's easiest and highest rated integration platform on G2. Learn More

Zapier gives you flexibility to integrate your CompanyHub account with thousands of apps to increase your productivity.

With PieSync your can connect your cloud apps with intelligent 2-way sync. PieSync will help you share customer contacts between your Marketing Automation, Email Marketing, Invoicing and E-Commerce apps.

In order for every CRM system to provide a true 360-degree customer view and provider maxium ROI, it is essential to provide a seamless integration with all the relevant enterprise applications.

CompanyHub provides you a small piece of code. Use this code to create form on your website, and just sit back and relax.